With a thriving innovation scene, Israel stands out as the “Startup Nation,” a hub of technological and entrepreneurial excellence. And in the rapidly evolving digital landscape, the way companies engage with their audience on social media platforms like LinkedIn offers insightful glimpses into their market influence and growth.

Our analysis examines the prominence of Israeli-founded most followed companies on LinkedIn in 2023. Later, we prioritized and re-ranked them based on two key metrics:

- Growth of new followers.

- Volume of engagement with their content.

The team at MAIA Digital compiled a list of the top 100 Israeli companies making waves on LinkedIn. This carefully curated data reveals key insights into what drives success on the world’s premier professional platform.

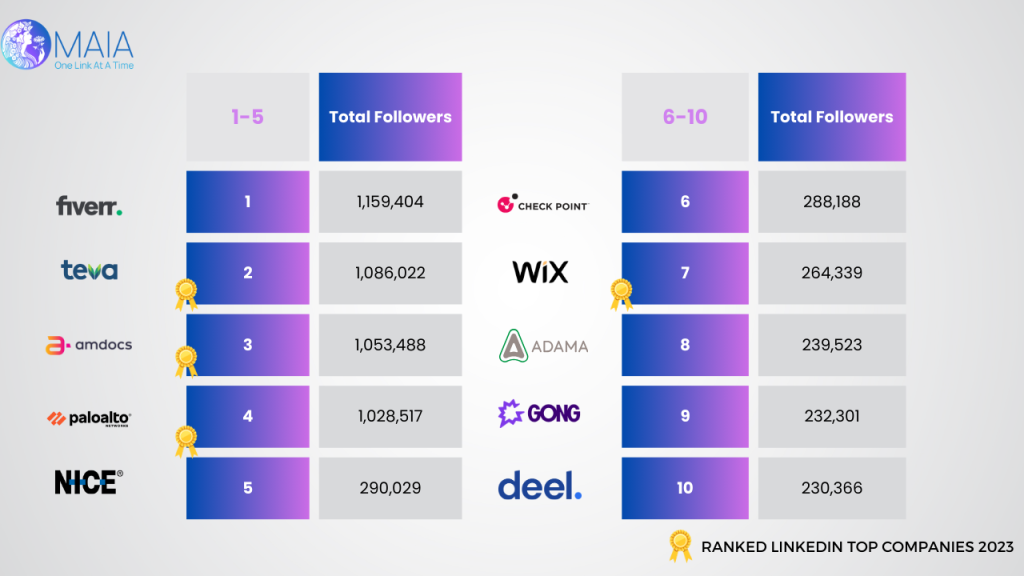

The Top 10 Israeli Companies on LinkedIn in 2023

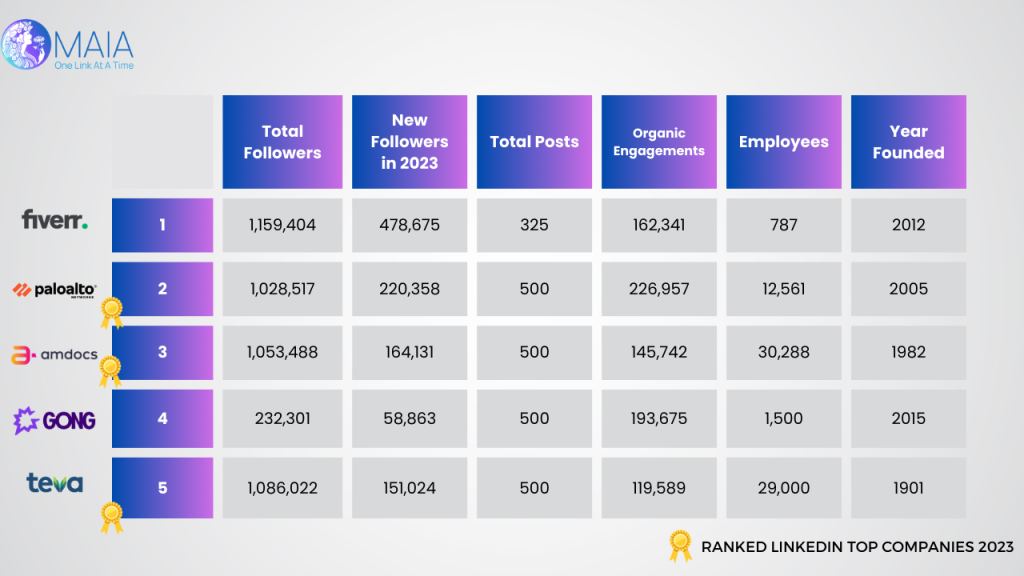

- Fiverr: Leading the chart, Fiverr’s massive gain of 478,675 new followers and its impressive 162,341 total engagements in 2023 showcase its robust and growing influence on LinkedIn.

- Palo Alto Networks: With 220,358 new followers and the highest total engagements of 226,957, Palo Alto Networks stands out for its active and engaging presence.

- Amdocs: Amdocs’ notable increase in followers and significant engagements, tallying at 164,131 and 145,742 respectively, reflects its strong and consistent digital footprint.

- Gong.io: Emerging as a dynamic player, Gong.io’s substantial engagement rate, paired with a healthy increase in followers, marks its rising prominence.

- Teva Pharmaceuticals: A veteran with deep roots, Teva maintains its relevance with 151,024 new followers and a solid engagement count.

6. Check Point Software Technologies: Demonstrating a balanced growth in followers and engagements, Check Point remains a key player in the digital space.

7. Deel: Marking its territory, Deel shows impressive growth with a significant number of new followers and engagements, highlighting its expanding influence.

8. Nice: With a substantial increase in new followers and steady engagements, Nice continues to build its online community effectively.

9. Wix: Despite a lower position in this ranking, Wix’s engagements and new followers indicate its steady presence and growth on LinkedIn.

10. Adama Ltd: Rounding out the top ten, Adama Ltd. shows a commendable increase in followers and engagements, signaling its growing digital footprint.

Lessons from Israel’s Top 10 Companies on LinkedIn:

High Follower Growth in Emerging Digital Markets

Companies in burgeoning sectors such as e-commerce and digital services are witnessing substantial growth in followers. This trend underscores the escalating interest and engagement in these dynamic markets.

- Example: Fiverr, leading with an impressive new follower count of 478,675 in 2023, exemplifies the growing interest in digital marketplaces and the gig economy.

Strong Online Presence in Established Industries

Conventional sectors, including pharmaceuticals, are not just sustaining but also amplifying their digital presence, utilizing platforms like LinkedIn for engagement and demonstrating thought leadership.

- Example: Teva Pharmaceuticals, a stalwart in the pharmaceutical industry, attracted 151,024 new followers, highlighting its enduring relevance and appeal.

High Engagement in Tech and Cybersecurity

Technology and cybersecurity entities are achieving more than just a growing follower base; they are also engaging deeply with their audiences, reflecting a keen and active interest in these domains.

- Example: Palo Alto Networks, with a staggering 226,957 total engagements, highlights the immense interest in cybersecurity solutions.

Consistent Content Posting as a Catalyst for Engagement

Regular and consistent content posting on LinkedIn emerges as a crucial factor for heightened engagement, aiding companies in maintaining their visibility and relevance.

- Observation: Companies such as Amdocs, Palo Alto Networks, and Gong.io, each with 500 posts, show a correlation between frequent posting and high engagement figures.

Rapid Follower Growth in Emerging Enterprises

Newer companies, particularly in cutting-edge sectors like workforce solutions, are rapidly expanding their follower base, signaling strong market interest in novel solutions and ideas.

- Example: Deel, amassing 133,329 new followers in 2023, illustrates its swift rise in audience engagement.

Engagement Versus Follower Count

A large follower base doesn’t necessarily equate to high engagement, underscoring the importance of quality content and strategic engagement approaches.

- Observation: Firms with smaller follower counts, such as Nice and Adama Ltd., still manage to garner significant total engagements.

Adaptability Across Ages

The varied founding years of these companies, ranging from Teva Pharmaceuticals in 1901 to Deel in 2018, demonstrate that both long-established and newer companies can successfully leverage digital platforms. This diversity indicates that success on LinkedIn is less about the age of a company and more about how effectively it adapts to and engages with the digital audience.

Success Beyond Size

The employee count of these companies, ranging from just under 800 at Fiverr to 29,000 at Teva Pharmaceuticals, underscores that the effectiveness of a company’s LinkedIn presence isn’t directly proportional to its size. In fact, LinkedIn’s “Employee Advocacy” research reveals that employee networks typically have 10x more connections than a company’s own followers. This means that smaller companies can amplify their reach exponentially through their employees’ networks. Content shared by employees is perceived as 3x more authentic than that shared by CEOs, adding a layer of trust and engagement that cannot be matched by corporate communications alone.

Furthermore, just 3% of employees sharing company content can drive over 30% of total engagement, demonstrating that even a small group of active employees can make a significant impact. Therefore, regardless of their size, companies that empower and encourage their employees to share content can have as much, if not more, impact as larger ones. This is achieved through strategic employee engagement, authentic content sharing by employees, and leveraging the vast network connections that individual employees bring.

In conclusion

The success of Israel’s top 100 companies on LinkedIn and the top 10 in particular demonstrates valuable lessons for businesses today. Fiverr’s follower growth teaches us that true digital success transcends mere numbers, tapping into emerging market trends like the gig economy. Palo Alto Networks’ high engagement underscores the importance of quality interactions over large follower counts.

The consistent content posting strategies of companies like Amdocs and Gong.io highlight that regular, quality engagement is key to keeping audiences captivated. The diverse appeal of various sectors, from traditional industries like Teva Pharmaceuticals to innovative companies like Deel, shows that digital platforms are versatile tools for growth across all fields.

This adaptability is further emphasized by the rapid follower increases in emerging sectors and the impactful content strategies of firms with smaller follower bases, like Nice and Adama Ltd.

Collectively, these insights from Israel’s leading companies on LinkedIn reveal the critical importance of a strategic online presence, consistent engagement, and the adaptability to digital trends for businesses aiming to maintain relevance and leadership in the evolving global digital landscape.

Explore the entire list of companies in top 100:

11-20:

Solaredge Technologies

Esg Today

Monday.Com

Redis

Tel Aviv University

SentinelOne

Payoneer Global

Liveperson

Cyberark

Playtika

21-30:

Sapiens

Verint Systems

Zim Integrated Shipping Services

Via

Walkme

Technion – Israel Institute Of Technology

Lemonade

Ironsource

Stratasys

The Hebrew University Of Jerusalem

31-40:

Wiz

Appsflyer

ICL Group

Elbit Systems Ltd

Wand

Rapyd Financial Network

Multiplymii

Seeking Alpha

Checkmarx

Mobileye

41-50:

Waves Audio

Skai

Taboola

Ben-Gurion University Of The Negev

Playtech

Etoro

IAI – Israel Aerospace Industries

Cybereason

Israel Innovation Authority רשות החדשנות

Israel Defense Forces

51-60:

Bar-Ilan University

Investing.Com

Bigid

Ethosia

Imperva

Netafim

Varonis Systems

Clearml

Outbrain

Snyk

61-70:

רפאל מערכות לחימה מתקדמות – קריירה

Lumenis

Matrix

Gloat

Ceragon Networks

Pendo.io

Kaltura

Cognyte

Gilat Satellite Networks

Papaya Global

71-80:

Similarweb

Cellebrite

Applause

Crazylabs

Radware

Pagaya Investments

Fireblocks

Cato Networks

Telit Wireless Solutions

Calcalist כלכליסט

81-90:

Aqua Security

Moon Active

Trigo

Sisense

Bluevine

Hibob

Optibus

Reichman University

Elementor

Jfrog

91-100:

Pentera

Start-Up Nation Central

University Of Haifa

Forescout Technologies

Rafael Advanced Defense Systems

Ownbackup

Weizmann Institute Of Science

Sodastream International, Ltd.

Moovit